Taking Care of Excess HSA Contributions

Excess contributions in your HSA can lead to tax penalties. Here’s how to take care of any extra funds you contributed to avoid tax violations.

It’s well known that the IRS sets a yearly maximum contribution amount for Health Savings Accounts; but what if you accidently contribute too much? Here’s everything you need to know about making an excess contribution, from possible repercussions to how to get it reversed.

What is classified as excess contribution?

This answer is pretty easy – any amount of money contributed to your HSA over the maximum contribution amount designated by the IRS. Your employer may automatically end your yearly contributions when you reach the maximum amount. If you make your own contributions, then pay close attention to the amount you’re depositing and the limit.

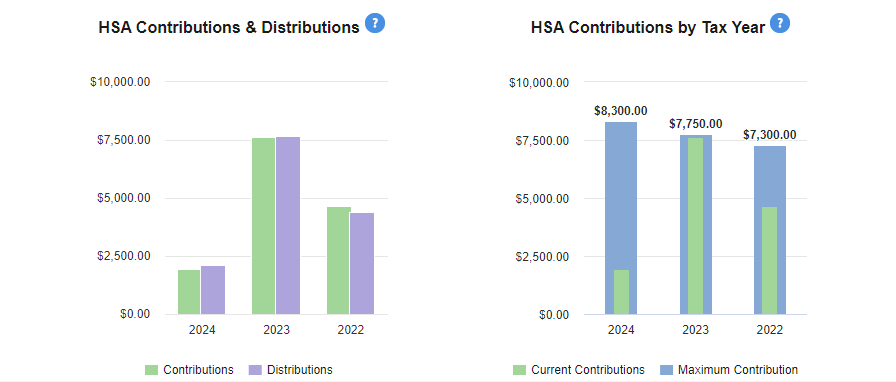

Within the HSA Central Consumer portal you can quickly see your maximum contribution limit based on your level of coverage, and how much you’ve contributed toward that limit. Make sure your coverage level of Individual or Family is properly selected to help you track your progress.

Possible Repercussions

Any excess funds added to your HSA account are subject to both income tax and an additional 6% excise tax. Both taxes are applied each year until your contribution amount is corrected. The good thing is these taxes are processed with your yearly tax return. This gives you time to monitor your yearly HSA funds and make a correction before filing your taxes.

Reversing Contributions

Luckily, correcting an excess contribution amount is pretty easy. All you have to do is fill out the Excess Contribution form found on the HSA Central Consumer Portal. The form is located under the Tools & Support section and can be mailed, faxed, or emailed to the provided designated destination. Make sure to check the Excess Contribution Removal box and provide the date the account was over contributed into. This ensures the over contributed amount is adjusted and not be included in the contribution totals for the tax year. The excess funds are then placed in your linked bank account, or you will be mailed a check.

This icon indicates a link to third-party content. By clicking on the link, you will leave our website and enter a site not owned by the bank. The site you will enter may be less secure and may have a privacy statement that differs from the bank. The products and services offered on this third-party website are not provided or guaranteed by the bank.